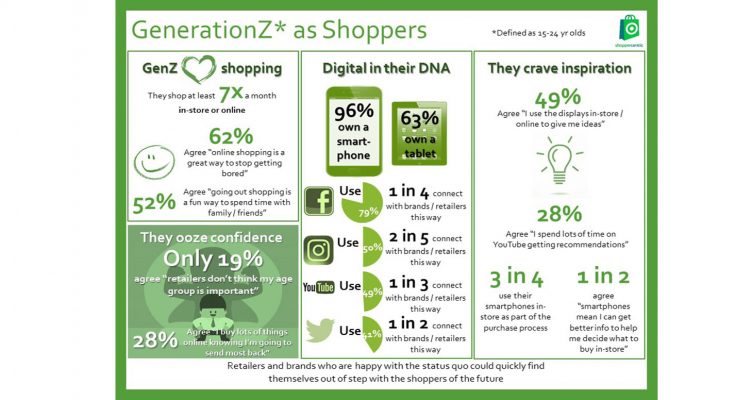

Generation Z shoppers (those aged from 15 to 24) are shop-happy and digitally-savvy consumers who are open to being influenced by retailers – but they also have high expectations of them.

They are more likely than the general shopping population to think that retailers consider their age group important, while half of them believe that retailers and brands understand their age group, compared with a third of the rest of shoppers.

Danielle Pinnington, Managing Director at research company Shoppercentric, which has published the new report, says: “Generation Z are a fascinating section of the shopper population. They’ve grown up in a truly connected world and are starting to access the kind of money that means they can flex their spending power. A lot has already been written about who they are as consumers, but there’s been no particular focus for those interested in shoppers. We wanted to take a closer look at what their expectations and needs are since they may not be today’s big spenders, but they could give a real pointer to where the future of retail lies… if we take the time to listen to them.”

Other findings of the report include:

- Generation Z are more likely to say that happiness runs deeper than material possessions alone: 34% strongly agree that they want to feel they are getting good experiences and that life isn’t all about what they own, versus 28% of older shoppers.

- Generation Z shop (instore/online) at least seven times a month (rising to eight times a month amongst the men in this age group). For them, going to physical shops and malls is as much a social pursuit as it is about buying things: 52% of Generation Z said that going out shopping was a fun way to spend time with friends/family, versus 44% of adult shoppers at large.

- Ecommerce provides a welcome distraction for Generation Z, with 62% of them agreeing that online shopping is a great way to stop getting bored, compared with 53% of older shoppers. Indeed, 70% of Generation Z shoppers agree that they “often browse online with no intention of buying (versus 63% of older shoppers).

- Just over one in four Generation Z consumers (28%) say that they spend lots of time on YouTube getting ideas and recommendations, compared to 13% of older shoppers. They are also twice as likely as other shoppers to cite product displays as important when shopping instore, and 49% agree that they use the displays instore/online to give them ideas (versus 41% of the broader shopping population).

- They also use their smartphones in-store more often, with 53% agreeing that this way they can get better information to help them decide what to buy when instore, compared to 38% of older shoppers.

- Generation Z consumers love a bargain: 48% agree that they tended to buy the cheapest they could so that they could buy more things they really like. 62% are also tempted to buy if an item is on promotion versus 55% of older shoppers.

- Generation Z are also the first truly digital generation, having grown up with the Internet and the World Wide Web. Almost all of them (97%) have either a laptop or a PC, 96% have a smartphone and 63% have a tablet.

- The biggest problem for retailers is that Generation Z are Generation Returner – they have no problem buying more items than they want, and returning what they don’t want. In fact, 28% of Generation Z agree that they buy lots of things online knowing they’re going to send most back, compared with 10% of older shoppers.

- They are more impulsive and more willing to take risks with an order than older shoppers; 44% of Generation Z say that they often buy things on the internet that they hadn’t planned to purchase, versus 32% of older shoppers.

- Speedy delivery is more important to Generation Z than to older shoppers, with one in five putting same day/next day delivery in their top three most important factors for shopping online, compared with one in ten older shoppers.

Social Media plays a huge role for Generation Z, and they are more likely than older shoppers to be connecting beyond their social groups of family and friends or even like-minded groups, to retailers or brands. Specifically:

- 79% of Generation Z use Facebook vs 66% of older shoppers; 24% regularly use it to contact retailers or brands.

- 50% of Generation Z use Instagram vs 17% of older shoppers; 41% regularly use it to contact retailers or brands.

- 49% of Generation Z use YouTube vs 27% of older shoppers; 32% regularly use it to contact retailers or brands.

- 41% of Generation Z use Twitter vs 26% of older shoppers; 48% regularly use it to contact retailers or brands.

Pinnington observes: “We’re all aware that Generation Z are easily bored and have a very short attention span, but on the flipside, they have great confidence and a terrific support system provided by social media which helps them to manage risk when they’re choosing what to do and what to buy. Plus they’re aware that retailers are interested in them and that they’re worth getting to know – this is in stark contrast to how many older shoppers feel.”

She concludes: “Generation Z know that they’re being courted, so it stands to reason that they expect to be impressed before they part with their cash. This apparent self-assurance is important because it will set a high bar against which retailers and brands will be judged moving forwards. Each touchpoint with these shoppers needs to be a positive experience and reflective of the brands’ tone of voice and values whilst remembering that this is a generation that enjoys shopping, so retailers will need to deliver to that brief and make it fun both instore and online.”