Opinion From IncentiveSmart

There are some things we can’t help but resent spending our money on. When that ‘Check Engine’ light starts glowing, or when the school uniforms get a little too tight once again, or when the dentist sits back in her chair and says, “I’ll need you to book another appointment”. They are the bare necessities – and, unlike the bear necessities, they definitely aren’t free to scavenge from the forest floor as you hum a merry tune.

The supermarket is another place where spending hard-earned money rarely feels like a joy. Besides the occasional treat snuck into the trolley, there are plenty of bare necessities that make their way down the conveyer belt quite unceremoniously.

This is, of course, why supermarket loyalty schemes prove so successful. Most of us have to go to the supermarket at least once a week and, unless it’s way out of our way, the supermarket with the most beneficial (and, most importantly, memorable) loyalty scheme is likely to be our destination.

That brings us onto to Asda, who recently unveiled a new pounds-based rewards scheme for their customers – a novelty in the supermarket circle, given the emphasis Asda’s main competitors place on points, rather than pounds. And, when it boils down to the age-old debate between money and points, Asda’s new efforts are just as relevant to B2B loyalty as they are to the traditional, B2C loyalty schemes.

So, here it is – our in-depth, up close and personal look at Asda’s new rewards scheme – what we admire, and what experience has taught us we’d rather steer away from.

Asda’s Rewards Scheme: What’s the Deal?

Back in August, Asda started rolling out its first loyalty programme. While they were late to the game (Tesco launched their Clubcard back in 1995, for instance) the supermarket had maintained a competitive edge through the years with its rollbacks and competitive pricing strategy.

Asda Rewards is centred around a ‘Cashpot’, which grows larger each and every time shoppers scan their app at checkout, or complete ‘challenges’. This is the interesting part – the money in this Cashpot can be redeemed through a voucher, which can be put towards their next Asda’s shop (either in person, or online). Is that not a voucher scheme we ask?

The scheme is made more unique by the challenges ASDA offers to shoppers (for instance, £1.50 can be earned for any 10 items of fruit and vegetables), and by the ‘Star Products’ found throughout the store that can earn a 10% return in their Cashpot. It’s obvious that these challenges are designed to encourage shoppers to spend more time in store, more time looking for things (and trying new things they wouldn’t usually go for), and, ultimately, spend more money.

It’s a great idea, aside from one pretty big detail – historically, points-based rewards have demonstrated far better success rates in the long-term, even though we love having a little extra cash to spend when temptation is right in front of us.

Our Reservations Over Cash-Based Rewards

We get it. Finding an extra £20, getting that better-than-expected tax rebate, or opening a birthday card to find a handful of notes is a good feeling. We all like to know we’ve got a little no-strings-attached cash to spend on something extra, or just take the sting out of an unavoidable expense. This is, of course, the motivator behind Asda’s scheme. Shoppers can spend their accumulated ‘cash’ on a few extra treats among the usual cupboard supplies.

The counterargument, however – and one that we align with at Incentivesmart – is that cash isn’t memorable, and the kind of stuff we usually spend those unexpected extra doses of cash aren’t long lasting, either.

Remember what we said at the beginning of this article, about how there are some things we will always resent spending money on because they’re boring necessities? Add to that list things like toilet roll, dishwasher tablets, toothpaste, lightbulbs, washing up liquid, and socks! Saving a little on these humdrum expenses is all well and good, but it’s not exciting or memorable in the same way that accumulating points is – when you have to take time to think about exchanging them for rewards and experiences that actually mean something.

It’s very likely that Asda is aware of this. Why? Because their in-app challenges cater to that part of us that enjoys working toward a goal, rather than simply accumulating points with each purchase. It gives customers a more active role in the scheme – something which is usually reserved for points-based reward schemes.

Now, the obvious counter-counter argument in favour of cash-based rewards is that Asda operates in a very different ecosystem to most businesses. Supermarkets aren’t like other businesses offering rewards schemes. We go to the supermarket very regularly and, often, our choice of supermarket is also dependent on other factors: which one is closest to where we live? Which one stocks the brands/products we like the most? Which one suits our budget?

Where Do Points Have the Edge?

There are plenty of reasons why points continue to hold an edge over pounds, even in the unique world of supermarkets – and even when you take into account the surface-level appeal of cash over points, which only hold value within a closed loop environment.

Consider the fact that, in a recent survey, Tesco’s points-based Clubcard still ranked #1 among customers. Asda ranked fourth, behind Sainsbury’s and The Co-Operative, both of which also offer points-based schemes. The offer of cash is not, in and of itself, an instant selling point; customers are a lot savvier than that.

We spend a lot of time thinking about rewards schemes, and how to offer the best (and most enticing) programme to your customers, so we have some ideas of our own about why this could be. Here are just a few…

Points make consistency easier for businesses

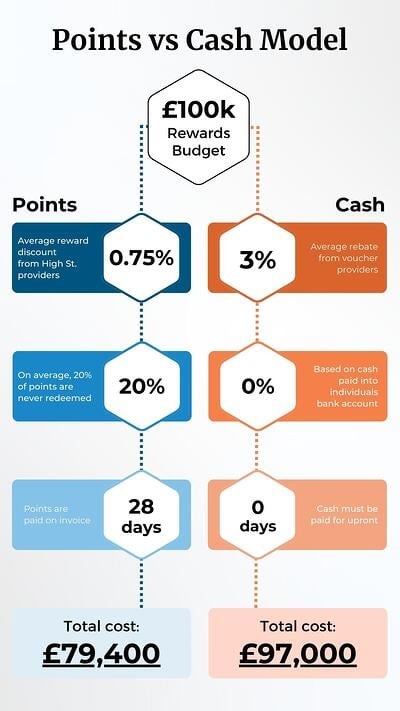

Giving away tangible rewards or experiences makes better financial sense than giving away cold hard cash. Why? Because, with a carefully planned points-based rewards scheme, you can accrue and offer some genuinely enticing rewards to customers without narrowing your margins on your own products or services.

Consider the fact that Asda’s first ‘Milestone Mission’ for customers is to spend £50 in-store or online. If they hit that milestone, they get £1.50 back, which works out at 3%. Another offer mentioned on Asda’s own site is £1.50 for any 10 fruits or vegetables (so unlocking this milestone will, presumably, cost less than £50), while another will see £5 invested into the Cashpot for every £25 spent on school uniforms.

The rules are inconsistent. It could be argued, of course, that this inconsistency is what keeps the scheme fresh, and what keeps customers checking in on their Asda Rewards app. If it was the same old deal every time they went in store, it wouldn’t be so memorable, right?

But how long can the novelty sustain itself? The benefits of a scheme that is based on a very simple, memorable, and clear system (for instance, 1 point for every £1 spent, and £1 for every 100 points accrued) remain clear as day – and, judging by Tesco’s popularity with customers, the lack of novelty is not a fatal flaw. Why? Because the rewards themselves change – not the rules of the game.

Points keep customers within your closed loop, without restricting them to a limited range of rewards

One of the biggest reasons why cash rewards are a bad idea for businesses is because, after the reward has been handed over, you get no more insight into what customers are spending that cash on, or where they are spending it.

Asda know this, and they have circumvented the issue with their Cashpot, which can only be redeemed or ‘emptied’ in Asda’s stores or through its website, so it’s pretty much straddling the fence between cash and points. It looks like money and acts like money, but only within Asda’s own big-little ecosystem. Is that really cash because as we know cash can be spent anywhere!!

Money can be spent thoughtlessly; points are better accrued

Asda’s Milestone Missions do give shoppers something to work towards they’re accruing the cash just the same. Points require imagination – they give shoppers a definitive goal to work towards, and a real, motivating reason to keep accruing those points, and not to just spend them for the sake of it each time they start to build-up. And, provided you can focus on offering a really strong, versatile and exciting selection of rewards for customers to spend their points on, allow them to mark favourites so they can identify what appeals to them, you can capture their imaginations for the long-haul.

Points are best for getting customers emotionally involved in the scheme

Building loyalty isn’t just about giving customers a reason to come back to you each time they need the product you offer, or the service you provide. It’s also about cultivating a long-term, steadfast emotional connection that will keep your customers loyal even when your competitors are offering a better on-the-spot deal.

An emotional connection is the difference between casual loyalty, and the evangelistic behaviour that can enable businesses to really thrive – the customers who will recommend you to friends and co-workers, and who will represent the bedrock on which your business’s success is built.

Cash is, as we mentioned above, unmemorable, and pretty workaday. Unless it’s a massive lump sum inheritance or prize money, you’re probably not going to remember it a couple of weeks, a few months, or a year down the line.

Points create a story in our heads. The process of picking out a reward you want and very gradually working toward it is different and, provided the rewards are relevant enough to really inspire your customers to earn them, very memorable indeed.

Points are better value

The final cherry on the cake is that commercially, points provide better value than cash. We’ve provided a simple points vs cash model to demonstrate this:

So, What’s our verdict?

Asda’s rewards scheme is likely to prove a success. They already have a significant (and, in all likelihood, loyal) customer base, and a solid reputation for offering competitive, in-store deals and prices that kept customers coming through the doors long before it launched this scheme. So, for many people, this will represent something of a cherry on the cake, rather than a game-changing, supermarket-switching prospect.

That’s not to say Asda won’t attract brand new customers, but that they will enjoy the main benefit of a successful loyalty scheme: customer retention.

More interesting to us is the fact that Asda’s rewards scheme seems to take advantage of the very best of both worlds. Cash is, at face value, a very compelling offer. We’ve said it before and we’ll say it again – ask any group of people whether they want to be rewarded with cash or stuff, and the overwhelming majority will probably say cash. But, once spent, that cash is forgotten – the purchase is lost to the sands of time – and the customer’s attention needs to be grabbed all over again. You give away more money, and the cycle continues.

The cash Asda gives to its customers through its Milestone Missions and Star Products acts a lot like points. It goes into a ‘Cashpot’ and customers can see that value accruing, which caters to our desire for money over stuff, but it can’t be redeemed as cash-in-hand or spent anywhere other than within Asda’s bricks-and-mortar or online stores. It keeps people within Asda’s closed loop, much like points.

What can we take from this? That collectability (aka points!!) will always offer the greatest possible benefit to businesses. They keep the loop closed and motivate the customer to keep returning and, in so doing, accruing points. You definitely don’t need to dress them up as cash to trick people to think that’s enticing, and you don’t need to invest crazy amounts of money into the rewards you offer. Instead, you need them to be relevant, memorable, and always interesting to your returning customers.