IPM Research Partner Zinklar Agile Market Research, recently published a report on the good and bad of the UK’s spending habits. UK & Ireland Market Lead, Abhijeet Roy, looked at what we do with our money, how we save up and the apps we use to manage spending.

For more information on how Zinklar can help your company save money on research projects, contact Abhijeet Roy on abhijeet.roy@zinklar.com

Consumers are prudent spenders. Even with a raise, half of us would prefer to increase our savings rather than splurge on a whim. 37% contribute towards their mortgage or household expenses, while half increase their monthly savings. Zinklar’s report unravels how and why consumers in the UK are changing.

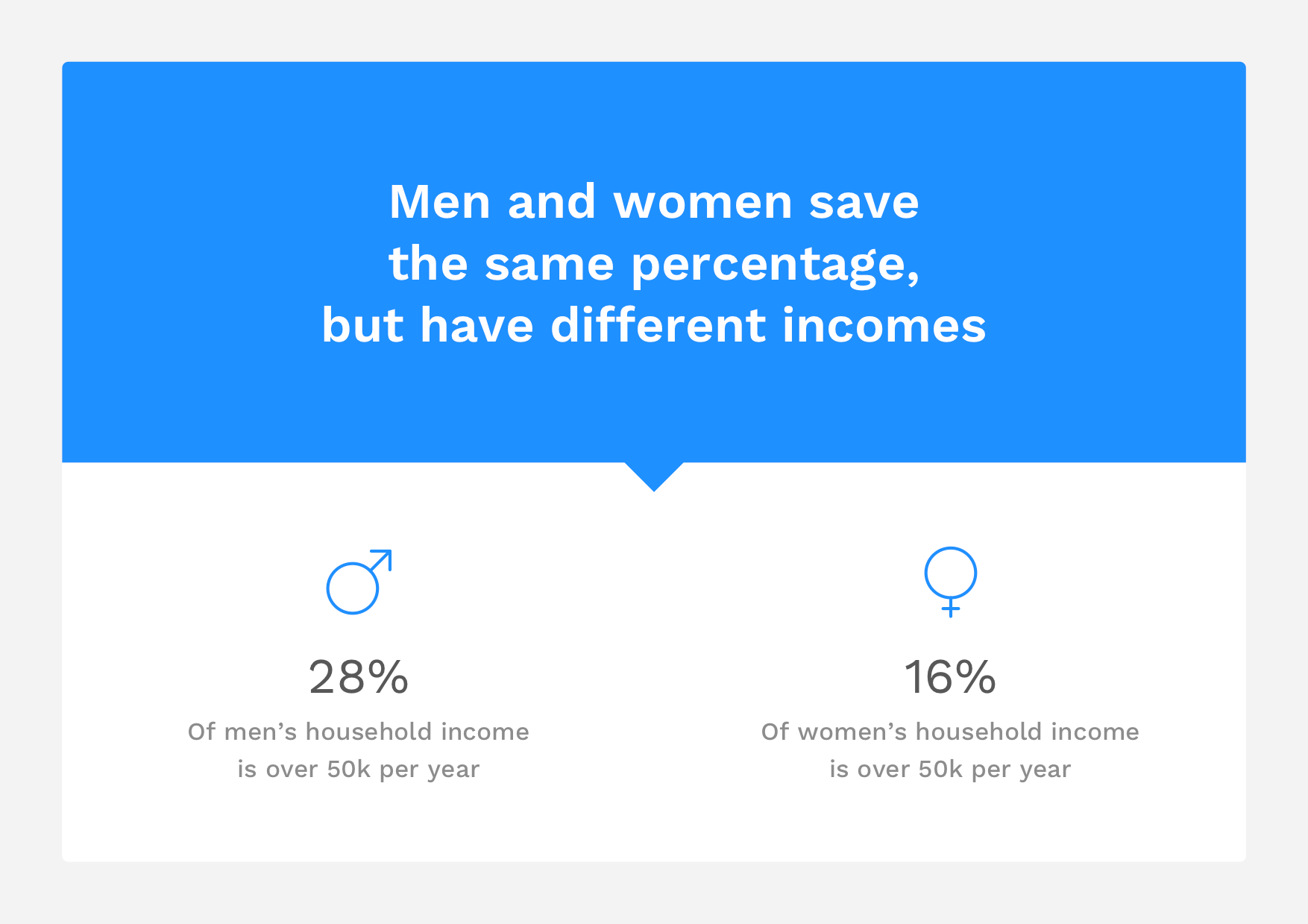

There are some rather unsurprising gender differences. Although men and women both save the same percentage of their income, they tend to fall on different income brackets. In fact, 28% of men report their yearly income as being higher than £50k, while only 16% of women do. Men end up having higher savings, which they are more likely to invest in bonds and other banking products.

“The good old times”: consumers feel like they’re not saving as much as before

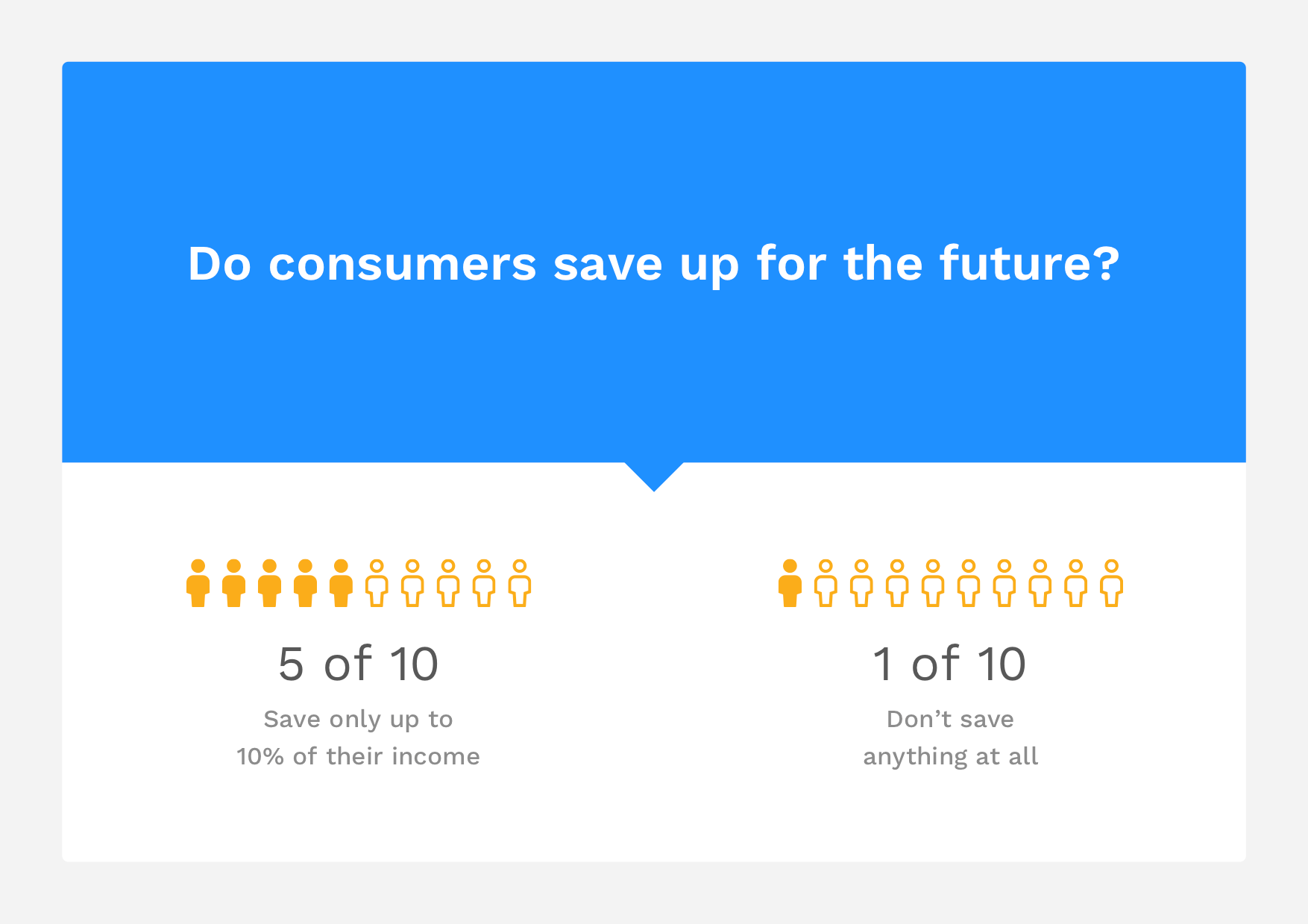

4 out of 10 consumers are either saving less money, have never saved, or are struggling to reach the end of the month. Only 2 in 10 consumers feel like they’re saving more than before. Nearly one third (and sometimes 40%) of people lack confidence in their ability to support themselves in the future and “maintain a decent quality of life”. In the context of zero-hour contracts and the gig economy, the pressure is on for consumers to set aside money for rainy days. We found that 1 of 10 people haven’t saved in their lifetime, and 1 of 10 people struggle to reach the end of the month. That’s 6 million people in the UK alone.

Still, consumers want to have fun. Entertainment and eating out are an important part of consumer’s lives and 1 in 3 still celebrate a pay rise by going out to venues, restaurants, or events.

Mobile banking is (already) the next big thing

In the UK, using apps to manage expenses is the norm. 25% of consumers always use a budget management app, and 60% of consumers use them with some frequency. A majority of UK consumers are mobile. And this number goes up the younger the consumer, 40% of under 24s always use budget management apps.

Challenger banks such as Monzo have defined this trend. Since their 2015 launch, they’ve surfed their way to a £16M Series A round by satisfying consumers’ desire for convenient and efficient banking. Traditional banks are being given a run of their money by new, agile and disruptive newcomers.

Zinklar’s takeaway insight is that app based, online banking, that’s easy to sign up for, has limited fees, no hidden expenses and helps you manage your money is the future of banking.

That’s why now, more than ever, being Customer Centric is key to success.