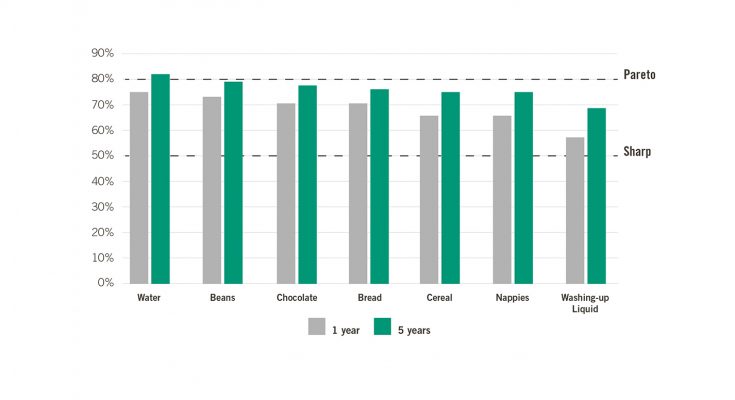

A new report from customer science and retail data experts dunnhumby reveals that the most frequent 20% of shoppers are responsible for 69% of a brand’s sales on average over the course of a year and 76% of a brand’s sales over a five-year period.

This directly challenges influential claims by academic Byron Sharp in his 2010 book ‘How Brands Grow’ that the most frequent shoppers are responsible for only up to 50% of sales, which many marketers have interpreted as downplaying the importance of the core customer base.

Adam Smith, head of media strategy at dunnhumby, said: “Thanks to Byron Sharp we have seen much debate around the value of marketing to your heaviest brand buyers, but this report reveals that marketers will be missing a trick if they focus solely on mass marketing at the expense of talking to highly valuable existing buyer segments. The research implies an optimal marketing strategy with a much greater balance between acquisition and retention than Sharp would advocate, while still going after your widest available market.”

The dunnhumby report, ‘Mass Marketing or Tailored for your Tribe?’, analyses the impact the most frequent brand shoppers have on sales over time, using the Pareto 80/20 rule as a measure (e.g. 20% of a brand’s customers are responsible for 80% of sales).

The trend for brands within a category to be reliant on a small group of customers is especially prominent with smaller brands by market share. Whereas market-leading brands realised 66% of sales from their top 20%, for other non-leading brands the figure rose to 78%.

“The growth of a brand’s market share is still in line with Sharp’s findings,” Smith adds. “Big brands have a lower Pareto share than small brands and the implication is that growth is associated with developing customers who are light and infrequent buyers. However, this research demonstrates conclusively that the value of the heaviest buyers has been under-estimated and is more in line with Pareto than not. Furthermore, significant differences between categories suggests the need for FMCG marketers to more fully understand the drivers at both brand and category level to optimise marketing investment. A simple one-size-fits-all mass marketing approach will not produce the best results and we see this with many of the brands we work with.”