UK marketers have revised their budgets up in the first three months of 2017, with significant growth recorded in internet and main media advertising categories, according to the latest IPA Bellwether Report published today.

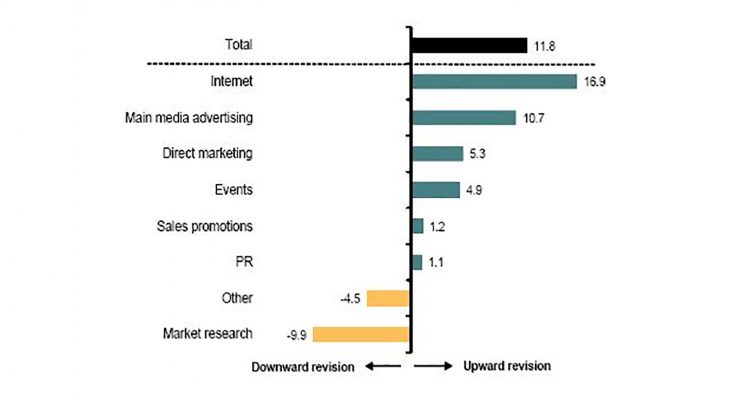

The report, which has been conducted on a quarterly basis since Q1 2000, reveals a net balance of +11.8% of companies registering an increase to their budgets during Q1 2017, down only fractionally from Q4 2016’s net balance of +12.9%. (The net balance is calculated by subtracting the percentage reporting a downward revision from the percentage reporting an upward revision).

Carey Trevill, Managing Director of the Institute of Promotional Marketing (IPM), says: “The latest IPA Bellwether report reflects the increasing optimism and the release of marketing budgets that we in the promotional marketing sector are seeing at the end of the first quarter of 2017. Brand marketers have realised that holding back marketing plans is bad for long-term brand health.”

However, she warns: “The relatively small rise in the index for Sales Promotion does not cover the vast majority of what the promotional marketing industry delivers for brands and companies and fails to take into account the integration of promotional techniques across all marketing channels and the development of new areas such as experiential and shopper marketing.”

Trevill adds: “Promotional marketing – marketing which aims to change behaviour by offering the target audience an incentive or reward – is incredibly powerful, and now permeates almost all marketing communications, including online, mobile and direct.”

Paul Bainsfair, Director General of the Institute of Practitioners in Advertising (IPA), observes: “Once again the Bellwether shows that while the impact of Brexit remains uncertain, marketers are continuing to invest in marketing. Furthermore, despite the current, turbulent digital ecosphere, it is clear that marketers are attracted to the cost-effectiveness of digital advertising and its ability to reach and accurately target their consumers.”

The Bellwether reports that UK marketers have indicated a positive outlook for their 2017/18 budget plans, with a net balance of +26.1% of companies signalling growth in their total budgets for the coming year. While indicative of a marked degree of confidence, the report’s authors suggest, year ahead expectations continue to lag those seen prior to the start of the global financial crisis in 2008.

Budgets were raised across a broad-range of Bellwether categories, led by internet where growth picked up to the highest recorded in just under four years (net balance: +16.9%, from Q4 2016’s +12.1%). Within this category, marketing activities related to search/SEO rose to the greatest degree in over two years, as highlighted by the net balance improving to +15.1% (from +7.1% in the preceding quarter). Mobile-based advertising also picked up, with the net balance of +10.3% (Q4 2016: +3.9%) the highest recorded in the short three-quarter series history.

Main media advertising also enjoyed a strong upward revision to budgets during the first quarter of 2017. The respective net balance jumped to +10.7% during Q1, up from +5.1% in Q4 2016 and the best recorded by the survey for just under three years.

Elsewhere, direct marketing budgets increased to the greatest extent for two years following stagnation in the previous quarter (net balance: +5.3%, from 0.0%), while there was a noticeable slowdown in the events category. Latest data showed the respective net balance declined to +4.9%, from +12.3% in the previous quarter and the lowest reading recorded by the survey for over a year.

Other categories that registered an increase in marketing spend included sales promotions (+1.2%) and PR (+1.1%). However, ‘other’ (-4.5%) and market research (-9.9%) both recorded deteriorating budget positions relative to those at the end of 2016.

Latest data revealed an improvement in company financial prospects during the first quarter of 2017. With over 32% of the survey panel indicating positive financial prospects, compared to under 19% that indicated a fall, the respective net balance of +13.9% was up from +11.2% in the previous survey period and the best recorded in over a year. That said, the degree of confidence remains well down on those levels seen over the period 2013-2015.

With the UK economy showing considerably more resilience during the second half of 2016 than was generally envisaged by economic commentators, this momentum is now forecast to carry through into 2017.

Although GDP growth is expected to slow in the first quarter of the year, the economy seems to have sufficient momentum to grow at a solid pace in 2017 (the OBR are expecting a rise in GDP of 2.0%). The Bellwether therefore predicts that this will help lift adspend by 0.6% in real terms over the year as a whole (previous forecast: -0.7%).

Further out, Bellwether predicts a stagnation in adspend in 2018, before growth recovers in 2019 and 2020 to rates of 1.8% and 2.3% respectively. However, given the difficulties in trying to predict the effects on the economy of Brexit negotiations and subsequent UK departure from the EU in 2019, current forecasts remain especially uncertain.

The Bellwether Report is researched and published by Markit Economics on behalf of the IPA. First published on the 17th July 2000, it features original data drawn from a panel of around 300 UK marketing professionals and provides a key indicator of the health of the economy.